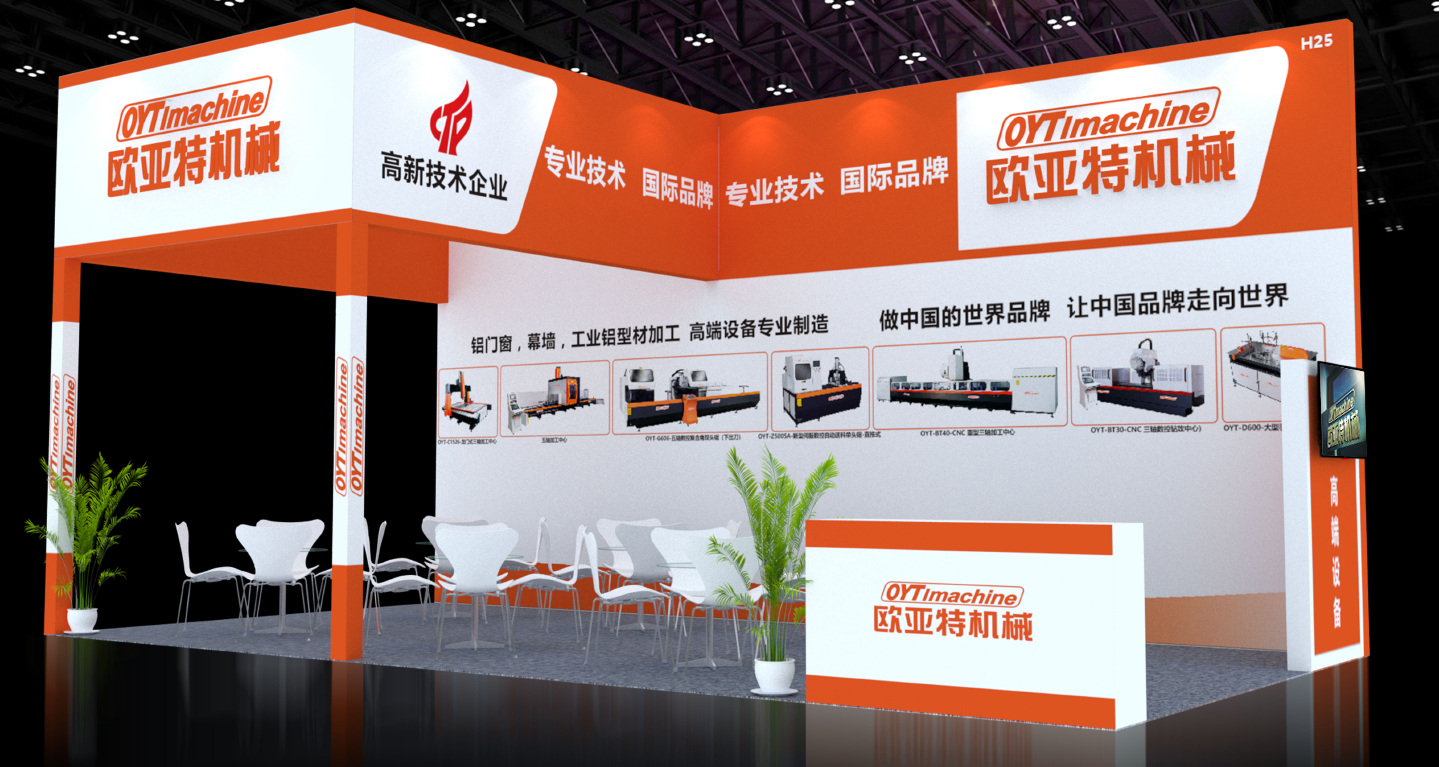

ky开元官网(中国)ky开元限公司是一家集研发、生产制造、销售、服务为一体的创新型企业。公司聘请了多名曾经在德国公司工作多年的高级工程师,拥有专业的研发、设计团队。产品主要引进德国、意大利先进技术和设计理念,再结合多年积累的行业经验;为铝门窗、幕墙、工业铝型材、轨道交通、航空航天、船舶舰艇、太阳能光伏、铝模板及建筑材料、工业电子电器行业提供优质、专业的生产加工设备及系统解决方案。

国家高新技术企业

国家高新技术企业

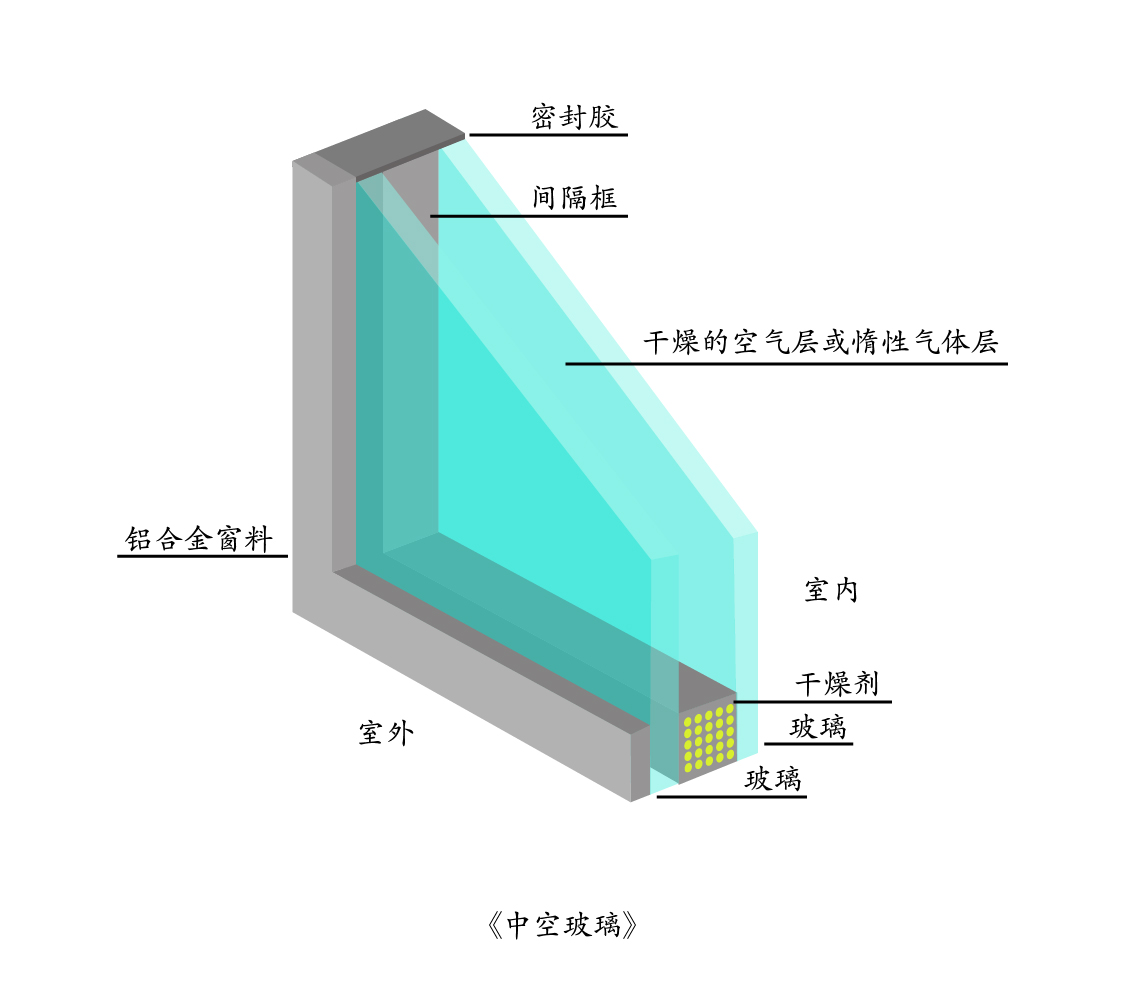

01普通铝合金型材与断桥铝合金型材的区别铝合金是以金属铝为主,加入一些合金元素来增强强度和硬度。铝合金再经过挤压成型,成为铝合金型材。普通铝合金型材整个为导体,传热和散热比较快。而断桥铝型材中的隔热条导热系数低,形成了冷热桥,内外能量无法通过型材进行交换,保温…

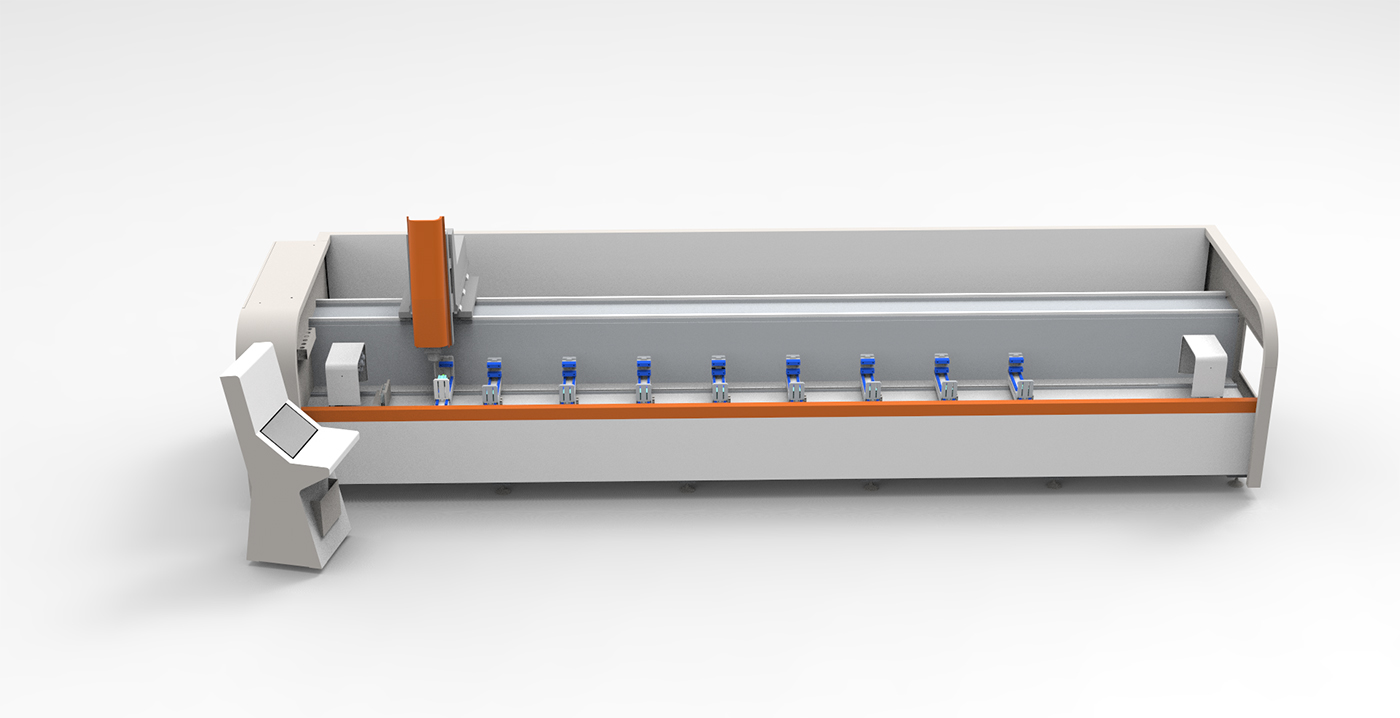

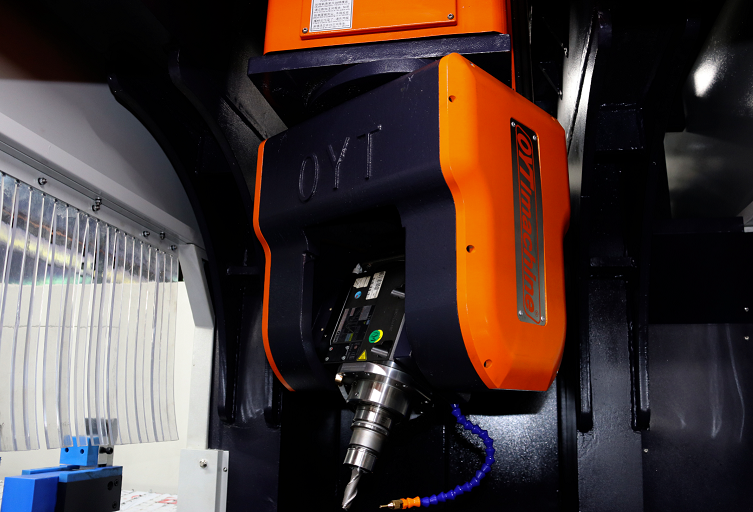

ky开元官网(中国)ky开元限公司自主研发并推出行业领先的3D导图编程软件和数字化无人工厂管理软件,成功实现CNC加工中心无纸化自动运行,不需要操作工有高超的编程技巧,大大的降低劳动成本。欧亚特牌加工中心配备两个独立加工区域,可同时对不同型材进行加工,这是增加生产力,降低劳动成本的另…

第26届铝门窗幕墙新产品博览会时间:2020.08.13-2020.08.15地点:广州保利世贸博览馆(广州市海珠区新港东路1000号)展位号:2C10欢迎光临!第26届铝门窗幕墙新产品博览会>>>

01丨无所不能的复合角切割※OYT丨五轴数控双头切割锯(专利产品)切割锯的机台转动和锯片倾斜,能实现各种复合角度的切割。※OYT丨幕墙料接口锯(专利产品)阳光房、玻璃幕墙料专用切角设备。※OYT丨十轴接口锯创造任意复合角的无限可能。02丨无惧任何门窗幕墙工业材大…

掌握一定的数控机床操作技巧不仅可以避免机床发生碰撞事故,还可以迅速提高操作者的数控机床操作技能,胜任本职工作。01全面了解机床构造1)了解机床的机械结构;2)掌握机床的轴系分布,特别是数控轴的正负方向;3)掌握机床的各部件的功能和使用;4)掌握机床各辅助单元的工作…

手工编程是指编程的各个阶段均由人工完成。利用一般的计算工具,通过各种三角函数计算方式,人工进行刀具轨迹的运算,并进行指令编制。这种方式比较简单,很容易掌握,适应性较大。下面我们了解一下数控编程步骤及需用到的代码:1. 编程步骤01、人工完成零件加工的数控工艺02、分…

企业流程管理主要是对企业内部改革,改变企业职能管理机构重叠、中间层次多、流程不闭环等,使每个流程可从头至尾由一个职能机构管理,做到机构不重叠、业务不重复,达到缩短流程周期、节约运作资本的作用。 流程管理最终希望提高顾客满意度和公司的市场竞争能力并达到提高企业…

提起铝合金,我们的第一反应往往是:铝合金门窗!我家的门窗,都是用铝合金材料的啊,可结实可好看,老好用了。铝本身是金属,铝合金通过加入其它金属材料加强了强度。因此其具有密度低、散热性好、抗压强的特点,它的硬度是传统塑料机械的好几倍,重量也轻了不少。其实,不只是…

铝是世界上使用最广泛的金属之一,但是你知道世界上生产铝最多的是哪些国家吗?铝是仅次于钢铁的第二大常用金属,也是地壳中含量最丰富的金属元素之一。尽管生活中您可能没有意识到铝,但周围到处都是铝。铝的最大特点之一是其回收能力。铝几乎可以100%回收再利用,值得一提的是…

双头锯是生产门窗幕墙时用的型材切割工具:1)OYT-五轴数控双头锯:切割锯的机台转动和锯片倾斜,能实现各种复合角度的切割;工作台摆角范围22.5°~135°,锯片摆角45°~90°,实现复合任意角度加工,可以满足异形材料角度加工;配备600mm硬质合金锯片。2)OYT-重型双头锯…

展会时间:2020年10月29日-11月1日展馆:北京·中国国际展览中心( 天竺新馆)展位:E4-610地址:北京·顺义 裕翔路88号地铁:15号线-国展站

展会:第四届 GME广东机床展展会时间:2021年9月23日-9月26日展馆:佛山潭州国际会展中心展位:4-083地址:佛山市顺德区工展路1号

会议名称:2021中国铝加工技术高峰论坛暨第十一届广东铝加工技术(国际)研讨会日期:2021年10月23日-25日签到时间:2021年10月23日 14:00~23:00 //2021年10月24日 08:00~08:30会议时间:2021年10月24日 08:30~21:00 //2021年10月25日 08:30~12:00地点:广东省佛山市禅城区希尔顿…

会议名称:2021广东(南海)铝加工产业技术大会日期:2021年11月26日-29日时间:2021年11月26日 14:00~20:00 签到2021年11月27日 08:00~08:30 签到 //08:30~12:00 技术大会 // 14:00~17:30 技术分会2021年11月28日 09:00~20:30 企业观摩技术交流2021年11月29日 10:00~18:00 企业…

MIC组装合成建筑法:装配式建筑是用预制部件在工地装配而成的建筑,被称为“组装合成建筑法”Modular Integrated Construction(简称MIC)。MIC将建筑先拆分成模块,每一个模块在工厂进行生产、组装、加工、装修等。组装合成建筑法有利于节约资源能源、减少施工污染…

电主轴是在数控机床领域出现的将机床主轴与主轴电机融为一体的新技术,它与直线电机技术、高速刀具技术一起,把高速加工推向一个新时代。 电主轴包括电主轴本身及其附件,包括电主轴、高频变频装置、油雾润滑器、冷却装置、内置编码器、换刀装置等。电动机的转子直接作为机床…

11月12日,佛山高新技术产业开发区管理委员会,公示了拟认定的2021年度瞪羚企业名单。ky开元官网(中国)ky开元限公司凭借在高端智能装备领域的深耕细作及在行业工业软件领域的积极探索成功入选。 瞪羚企业,是指成功跨过创业“死亡谷”后,商业模式得到市场认可,进入高成长阶段的…

2022年中国国际铝工业展览会移师广东佛山,联袂中国有色金属加工工业协会于2022年8月10-12日在广东潭洲国际会展中心(佛山)举办“华南国际铝工业展览会”。现场将完整展示铝及铝合金、铝加工材、铝制部件、制成品以及相关机械设备、辅料耗材在内的铝工业产业链的新产品、新技术…

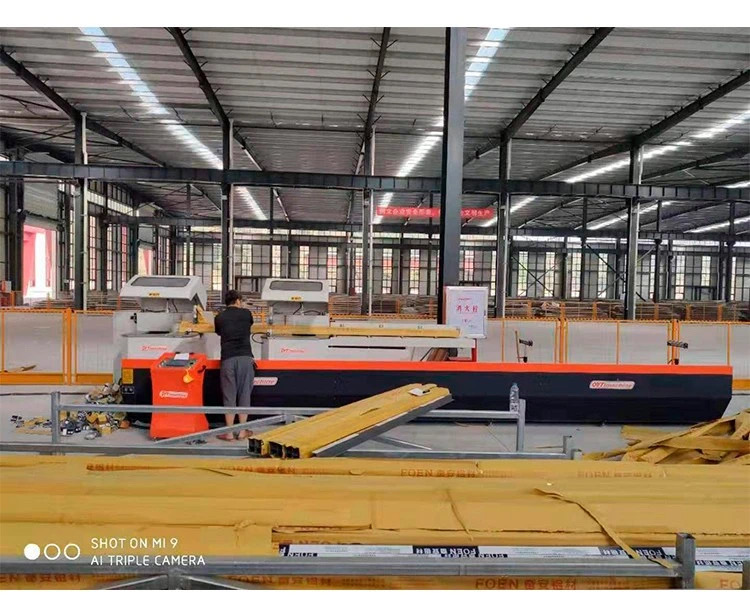

向深加工领域延伸,是当下铝加工行业高质量发展的重要方向,其对于铝加工企业实现转型升级、向上发展有着重要意义。在这样的趋势之下,铝型材深加工设备企业也迎来了良好的发展契机。3月26日上午,ky开元官网(中国)ky开元限公司(肇庆)智能装备产业园正式举行奠基仪式,ky开元官网(中国)ky开元限公司…

中建国际海外工程建设者们高质量、高标准推进项目建设奏响春耕“交响曲”绘就实干“春耕图”开罗时间3月13日上午阿拉曼新城超高综合体项目举行项目幕墙临时加工厂开工仪式为下一步幕墙施工奠定良好基础项目相关负责人、业主代表监理代表出席仪式项目相关负责人对幕墙加工厂开工表…

ky开元官网(中国)ky开元限公司|邀您参观第29届铝门窗幕墙新产品博览会展会时间:2023年4月7日-9日展馆位置:广州保利世贸博览馆展位号:2号馆2C37交通路线:1)搭乘地铁:乘坐广州地铁8号线抵达【琶洲站】,C出口直达展会现场。2)搭乘公交:乘坐广州公交:229路、239路、262路、304路、461路、…

春华秋实,时光不负。10月20日上午,秋风细雨,鞭炮阵阵。位于肇庆新区的ky开元官网(中国)ky开元限公司(肇庆)智能装备产业园隆重举行了主体建筑研发大楼的封顶仪式,ky开元官网(中国)ky开元限公司总经理罗贵兴携众多企业员工、合作伙伴及海外客商共同参与封顶仪式,现场见证了这一重要时刻。欧亚特…